The financial world has undergone a massive transformation over the last decade. Traditional banking methods that once required hours of paperwork and multiple visits to a physical branch are now being replaced by streamlined online processes. One of the most significant shifts has occurred in the way people leverage their personal assets for quick liquidity.

Gold has always been a preferred asset for securing credit due to its high value and cultural significance. Today, the process to gold loan apply has become faster and more transparent than ever before. By moving the application and initial verification stages to a digital platform, lenders have made it possible for borrowers to access funds with minimal friction.

Understanding the documentation and verification requirements is essential for anyone looking to navigate this modern lending landscape. While the digital gold loan process is designed for speed, it still relies on a robust framework of checks to ensure security for both the borrower and the lender. This guide explores the intricate details of how these applications are processed and what you need to prepare.

The Evolution of Gold Loans in the Digital Era

In the past, getting a loan against gold jewelry or coins was a purely physical transaction. You would carry your valuables to a shop or a bank, wait for an appraiser to test the purity, and then fill out stacks of forms. This process was often time-consuming and lacked the privacy that many modern borrowers desire. The emergence of fintech has changed this dynamic entirely.

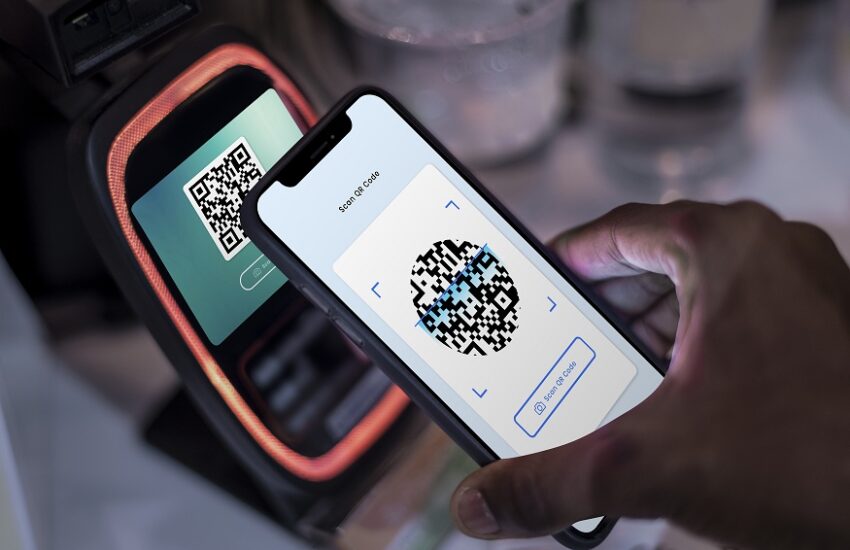

The modern digital gold loan combines the trust of traditional lending with the efficiency of modern technology. Borrowers can now initiate the process from their smartphones or computers. This shift has not only made the process more convenient but has also introduced a level of transparency that was previously missing. You can now track your application status in real time and receive digital receipts for every transaction.

Technology has also allowed lenders to offer more competitive interest rates and flexible repayment options. By reducing the overhead costs associated with maintaining large physical branches for every step of the process, digital-first lenders can pass those savings on to the consumer. This evolution represents a win-win scenario where the borrower enjoys better service and the lender benefits from more efficient operations.

Essential Documents for a Digital Gold Loan

When you decide to gold loan apply online, the first thing you need to do is gather your documentation. Even though the process is digital, regulatory requirements still demand specific proofs to verify your identity and eligibility. Most lenders require a standard set of documents that fall under the Know Your Customer or KYC guidelines.

The most critical document is your proof of identity. This is usually a government-issued ID such as an Aadhaar card, a PAN card, or a passport. These documents help the lender confirm that you are who you say you are. In many digital systems, you can simply upload a clear photograph of these documents or use an integrated system to fetch them from a digital locker.

In addition to identity proof, you will need to provide proof of address. This could be a utility bill, a rental agreement, or even your Aadhaar card if it contains your current residence details. Having these documents ready in a digital format can significantly speed up your application. It is important to ensure that the names and addresses match across all documents to avoid any delays during the automated verification phase.

The Digital Verification Process Explained

Once you submit your application, the lender begins the verification process. In a digital gold loan environment, this often happens in two distinct stages. The first stage is the verification of your personal details. Many lenders now use automated systems to cross-reference your ID numbers with government databases. This happens almost instantaneously, allowing for a much faster approval cycle than traditional methods.

The second stage involves Video KYC. This is a relatively new development that has revolutionized remote lending. During a Video KYC session, a representative from the lending institution will interact with you over a secure video call. They will ask you to show your original documents and may take a live photograph of you. This step is crucial for preventing identity theft and ensuring that the person applying for the loan is the actual owner of the documents.

This digital-first approach eliminates the need for you to submit physical photocopies in person. It also creates a digital trail that is much harder to forge or lose. For the borrower, this means less time spent traveling and more time focusing on their financial needs. The efficiency of this verification process is one of the primary reasons why the popularity of online gold loans has surged.

Verifying the Value of the Asset

While the personal verification happens digitally, the gold itself still requires physical inspection. This is where the phygital model comes into play. After your initial documents are verified, the lender will arrange for a valuation of your gold. Depending on the service provider, this might happen at your doorstep or at a nearby collection center.

A trained professional will assess the purity and weight of your gold ornaments. They use specialized tools to ensure that the gold meets the required standards, typically 18 karats or higher. In a digital gold loan setup, the results of this valuation are immediately uploaded to the lender’s system. The loan amount is then calculated based on the current market price of gold and the determined purity.

This step is vital because the gold serves as the collateral for your credit. The transparency of this process is often enhanced by digital scales and testing kits that provide instant readings. Once the valuation is complete and you agree to the terms, the gold is sealed in tamper-proof packaging in your presence. This ensures that your assets remain safe and untouched until you repay the loan and retrieve them.

The Future of Digital Gold Lending

The landscape of documentation and verification is constantly evolving. We are likely to see even more integration with centralized digital identity systems, which will make the process of a digital gold loan even faster. Artificial intelligence may also play a larger role in detecting fraudulent documents and assessing the risk profiles of borrowers more accurately.

As more people become comfortable with digital financial services, the demand for these streamlined processes will continue to grow. The focus will remain on making the experience as user-friendly as possible while maintaining the highest standards of security. For the consumer, this means more choices, better rates, and a more dignified way to access credit.

In conclusion, the shift toward digital gold loan applications has made borrowing more accessible and efficient. By understanding the documentation requirements and the verification steps involved, you can prepare yourself for a seamless experience. Whether you need funds for an emergency or a planned investment, the digital path offers a modern solution to an age-old financial practice.

Documentation and Verification in Digital Gold Loan Applications

Documentation and Verification in Digital Gold Loan Applications  Measuring ROI and Performance with Yext SEO

Measuring ROI and Performance with Yext SEO  Content Marketing Agency: Transforming Content Into Business Results

Content Marketing Agency: Transforming Content Into Business Results  The Demographic Shift: Who’s Really Using Personal Loan Apps?

The Demographic Shift: Who’s Really Using Personal Loan Apps?  Organising Modern Workspaces with Plastic Storage Containers and Stackable Storage Containers

Organising Modern Workspaces with Plastic Storage Containers and Stackable Storage Containers  Should You Hold Google Stock for 10+ Years? Benefits of Long-Term Investing

Should You Hold Google Stock for 10+ Years? Benefits of Long-Term Investing  Things You Need To Know Before Paying Your Rent Through Credit Card

Things You Need To Know Before Paying Your Rent Through Credit Card  Digital Bill Payments Shaping the Way People Handle Daily Expenses

Digital Bill Payments Shaping the Way People Handle Daily Expenses  Car Loan Handbook: Everything You Need to Know

Car Loan Handbook: Everything You Need to Know